Global Crypto Market Cap Falls 7% in the Past 24 Hours

As you all know, there has been a lot of uncertainty over the past few months about the cryptocurrency industry. The US SEC has delayed numerous BTC ETF applications, stoking fears that all cryptocurrency projects will be severely damaged by these delays.

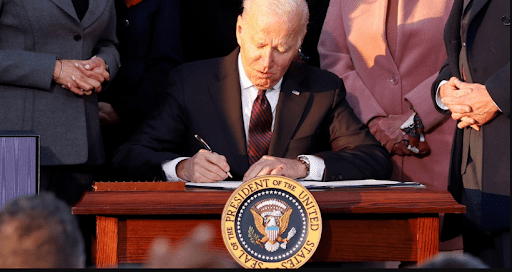

This fear appears to have manifested itself already, with the total market capitalization of all cryptocurrencies declining 7% in just 24 hours after US President Joe Biden officially unveiled the country’s 2021 Blockchain Infrastructure Bill. An estimated 3 Billion dollars were wiped off the Market Cap since this legislation was introduced.

There’s bad news and there’s good news. The good news is the Token Taxonomy Act (TTA) has passed in the United States Senate. The Token Taxonomy Act will exempt crypto startups from having to pay capital gains tax above $500,000 in yearly revenues. The cryptocurrency market cap increased by 15% after this.

America's rich crypto investors will owe more in taxes under Biden's latest 2021 plan.

A new infrastructure bill introduced by former US Vice President Joe Biden is catching some criticism for the hefty taxes it places on crypto investors. The infrastructure bill aims to raise $1 trillion in funds via a variety of new tax increases and other revenue sources that, according to the plan, will go toward America's infrastructure development.

The government has some specific targets in mind, your big names in cryptocurrency, but Biden is likely not going after the darknet makers and sellers out there. He is relying more on the billionaires such as Amazon's Jeff Bezos and Facebook's Mark Zuckerberg to bring in more of their crypto money. This idea is just one of many new notions for crypto that the current administration has come up with over time. All of which have been shot down.

This is a big one folks - giant in fact. The bill will in 2021 force all crypto investors in the US over a certain amount to tell the IRS everything. Right now a lot of people don't report their crypto taxes and this bill aims to fix that.

The buzz around cryptocurrency is louder than ever. This year, there were 17 cryptocurrencies with a total market cap of over $1 billion. People have been getting rich with early investments in Bitcoin, Ethereum, and other cryptos. For most investors who got involved in the crypto space in 2017 or earlier, their wealth is uncollateralized. Meaning they haven't yet paid capital gains taxes on it.

What about tax evaders?

The new provisions on crypto taxation introduced in the 2021 Infrastructure Bill by Joe Biden that target cryptocurrency-rich investors. Including the creation of a Cryptocurrency Tax Collection Office (CTCO) and a Cryptocurrency Tax Compliance Agency (CTCA) to target US tax evaders, and non-compliance makers by targeting the cryptocurrency market.

Two things Crypto Investors should know about the Infrastructure Bill President Biden just signed in 2021.

(1) The Bill requires crypto-currency exchanges to file tax returns on cryptocurrency transactions. The exchanges must report the value of the cryptocurrency transactions, the value of the payments in dollars, and the value of both relative to each other. What this means is that cryptocurrency exchanges will have to produce detailed, audited financial statements that support their valuations. And, these valuations will have to be certified by a CPA. This is good news for crypto-currency investors and crypto-currency exchanges.

(2) The Bill requires cryptocurrency exchanges to report to a government agency (the Department of Homeland Security) all transactions of cryptocurrency worth $10,000 or more. The exchanges will also have to provide other information about their markets and users to the government agency. This is bad news for crypto-currency investors and crypto-currency exchanges.

This new Infrastructure Bill calls for new federal standards for cyber security.

The bill imposes new reporting requirements on anyone who trades in more than $20,000 of virtual currency in a given year. It calls for new federal standards for cyber security. It repeals a 2015 provision that allowed people to avoid most taxes when the currency they sold was used to buy things.

Crypto-currency exchanges will have to obtain government approval before they launch. That's a good thing. But, the Bill doesn't say anything about what kinds of approval exchanges would have to get. We hope the exchanges will have to get approval before they start trading.

The Bill includes some provisions that the Securities and Exchange Commission hopes will use to make it easier and cheaper for exchanges to get approval. The Bill doesn't say anything about whether the SEC will approve or disapprove exchanges. We hope the SEC will approve exchanges.

One benefit is that the bill explicitly allows crypto-miners to deduct their expenses from their taxes.

The first is that the bill explicitly allows crypto-miners to deduct their expenses from their taxes, just like any other business could. To understand why that's important, we have to understand the way crypto-currency works.

Almost none of the major cryptocurrencies are issued by the government. The major cryptocurrencies are created through a process called mining. In mining, lots of people are all trying to solve the same problem, get together, and use their computers to try to guess the answer to a complicated math problem. The person who guesses the answer first gets to claim some newly created tokens.

The math problem the miners are trying to guess is generated by the cryptocurrency software. But it doesn't exist. It's made up. The software represents the crypto-currency itself. It's a code, and the code uses a set of algorithms to solve a complex mathematical problem.

The algorithms are complicated. They are measured in millions of lines of code, and no one can understand them. But in a complicated computer code, the rules say, "A line can contain anything. But it can't be any line except one: the instruction 'return.'”

So, for example, when mining cryptocurrency, you first download a program that will compile the algorithms into lines of code. Then you run this program on thousands of computers, each of which is solving part of the problem. When a miner guesses the answer, the program transfers the tokens to him.

To mine cryptocurrency, you have to buy computer equipment. Some of the equipment costs a lot, like graphics cards that mine cryptocurrency with graphics, mining software, and mining hardware. But other equipment, like small computers, costs very little.

But will the Infrastructure Bill be able to stop the people's technological interest and success?

There’s no doubt - cryptocurrencies are here to stay, and there’s nothing that can stop their sweeping success from transforming modern life as we know it into a bright, digital world.

Thank you for being a Ghacks reader. The post What crypto investors should know about the infrastructure bill signed by President Biden appeared first on gHacks Technology News.

0 Commentaires